Creating content that educates on a wealth of financial topics — from homebuying tips for first-timers to compensation insights for business owners — may seem like a no-brainer for a tier-one bank. However, getting U.S. Bank’s multiple lines of business on board with creating (and funding) a single content program to go beyond their products took business smarts, content marketing savvy and vision.

Don Kransteuber — U.S. Bank’s former VP and head of digital acquisition, SEO and content marketing — has all three.

He set out to learn what financial questions U.S. Bank customers and prospects had and hit the banking bull’s-eye when he was able to provide the answers in a unified U.S. Bank blog: Financial IQ.

Customers — and colleagues — came running. Two years later, the blog became a best-in-class enterprise content hub. Financial IQ showcases the bank’s expertise and provides answers to its different audiences. It also offers six content pillars that speak to the needs of U.S. Bank four customer and prospect groups: consumer, small business, commercial and wealth.

We asked Kransteuber about the evolving role of audience-first content in the banking industry, the value of piloting programs across the enterprise and what millennials want from their bank.

Q: Under your leadership, U.S. Bank launched the Financial IQ content hub. What prompted you to spearhead this bankwide initiative?

While U.S. Bank had a great repository of product-based content, what didn’t exist was a library of what I call “audience-first content,” which is content that addresses needs by answering specific questions like, “How do I buy my first home?” or “How do I pay for college?”

I had been leading the SEO practice at the bank and had seen firsthand that people were actively seeking this type of information online. I knew that an organization like U.S. Bank, which is focused on building meaningful partnerships with customers and interested in helping them reach their financial goals, was in a position to help.

Q: You saw an opportunity and seized it. How did you go about selling your vision of a needs-based content hub (as opposed to product-based) across the organization?

First, we had to figure out how to incorporate more audience-first content into our digital presence. We started with a small pilot site, a blog really, which we ran for about 18 months. With a limited amount of content and a few dollars for marketing and promotion, we were able to effectively prove that the site had a massive ROI.

We relied heavily on SEO and email to drive traffic, as well as a small native advertising buy. Our emails, which were exclusively educational in nature — no product promotion at all — had the highest open rates and click-through rates of all campaigns across the bank. And through multitouch attribution, we were able to connect this activity to sales at a cost per acquisition far lower than average — 90% lower, in fact.

That’s what opened people’s eyes to thinking that not only did this work activate our brand purpose around partnering with our communities and our customers, it also delivered an actual return in the form of new customers acquired for far less money. That was a huge win.

Q: Proving ROI is the holy grail of content marketers across industries, but unless every product was involved in the pilot, it’s not always enough to build consensus across business units. How did you get the execs across the bank’s enterprise on board with your vision?

It’s about finding the wins from your partners’ point of view. We had to show everyone how this type of venture can support their business goals efficiently and effectively. Even if you’re working in a company that doesn’t have a content marketing background, you can find examples of how others are putting audiences first and being educational guides—and benefiting from it across various company sizes and industries.

Q: What’s a guiding insight or statistic about connecting with U.S. Bank’s target audience that would surprise most of us?

Conventional wisdom says that millennials will always choose a digital self-service experience option versus a live, face-to-face interaction. But there’s still a contingent of millennials who research heavily online and then go into a bank branch to open an account. And I think that feeds into why banks are still adding branches. There’s still a dependency on face-to-face transactions.

To be successful, bank branches need to deliver the same type of experience that customers have come to expect from best-in-class retailers. Education will be a key element, delivered through learning centers, touch screens, iPads and anything else that enables the customer to self-serve and be guided through financial problem solving.

Q: What’s next for content at U.S. Bank?

The primary content marketing goal is to help identify solutions for audiences’ potential problems or challenges. Obviously, the bank has a lot of products and services that may lend themselves to that, but the goal with content is to help audiences overcome their financial difficulties. So a continued focus on financial education and inspiration (not products and services) is critical to ongoing success.

People learn from one another, by connecting and hearing each other’s stories. That’s how I see Financial IQ evolving.

Financial IQ is a platform to engage audiences on a more personal level. It can be a forum in which people share their stories about their path toward buying a home, starting a business, sending their kids to college or enjoying a worry-free retirement. It can be a community of people in similar situations learning from one another in ways that work for them (videos, podcasts, digital assistants — true omnichannel experiences that make Financial IQ more tangible for folks) and make it about more than just the bank sharing insights on how to solve their financial challenges.

Q: From a content marketing perspective, how do you think financial services marketing as an industry is evolving?

A challenge in our industry is that many of the banking products are viewed by consumers as commodities, so for banks to differentiate themselves they have to be highly engaging and deliver a best-in-class experience in their channel of choice. Across the industry, most of our peers are moving in a similar direction. Take a look at other financial institutions’ websites and you’ll see customer stories on their homepages, for example. Financial institutions are seeing the value in producing needs-based content, and educational content is being woven into the online websites — they’re not just sales sites anymore.

Now that more banks are creating more educational content, we have to be thinking about what’s next. I think the opportunity is in crossing over to offline channels like branches and call centers, where banks can help people get information. Think: seminars, webinars, hands-on labs, interactive learning stations and other engaging ways to learn.

Some concepts for “branches of the future” look like a cross between an Apple store and a Starbucks and provide the coffee bar experience with financial education and utility. Financial services companies are focused on the customer experience across all of their touch points and how to deliver what consumers have come to expect from other companies in other industries.

And it’s not just financial services. Take Tesla, for example. Tesla has opened stores in malls (of all places) where you can go in and check out a car and get the same type of experience we’ve come to expect from the Nordstrom or Neiman Marcus next door. Not exactly the typical car buying experience.

Q: Are there brands — in financial services or any industry — that you admire and learn from?

Apple and Starbucks are stellar brands in terms of the experiences they provide. I’m also very impressed by Toyota because of how it’s transforming from a car manufacturer to a mobility company.

Toyota is experimenting with concepts like automated self-driving vehicles that can turn into a hotel room, that can turn into an office, that can turn into a food truck. They’re not thinking in terms of making cars or trucks, they’re thinking about how to move people and solve problems around mobility.

Toyota had to do this to stay relevant. If there will be a time in the not-too-distant future when an increasing percentage of people can be picked up by an Uber, then why own a car? It picks you up, so why do I need to buy a car? They need to address that so they’re not disrupted.

I love reading about companies disrupting themselves and really looking far into the future. Because of all the disruption in the industry from fintech and other nonbank players, banks need to be thinking this way, too.

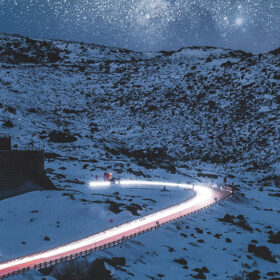

Photography by Bruce Williams